SALES AND SERVICE TAX (SST)

Frequently Asked Questions (FAQ) about Sales and Service Tax (SST)

1. What are the tax charges that is applicable for electricity services?

2. What is the rate of Service Tax applicable for electricity services?

The Service Tax rate was initially set at 6% as of 1 September 2018 and is increased to 8% starting from 1 March 2024 according to Service Tax (Rate of Tax) (Amendment) Order 2024 [Note: temporary message until end of August 2024].

The applicable Service Tax rate is 8% subject to the conditions mentioned on Q1.

3. Where can I find information regarding the list of taxable services, which includes electricity services?

Information regarding taxable services, individuals and the total value of taxable services can be found in the First Schedule [Regulation 3] under the Service Tax Regulation 2018.

4. Which TNB Customer Categories are applicable to Service Tax?

.png)

For more information regarding customer categories, please visit: 5. Why is my billing period less than 28 days?

Generally, the monthly billing cycle is set from 28 to 31 days. However, the billing period can be less than 28 days in the following scenarios:

No, non- Residential customers are not governed under the Service Tax Act 2018.

7. Will my electricity bill show how much Service Tax I have to pay?

Yes, but this applies only to residential customers (Tariff A- Domestic). You will find a seperate line item clearly showing the Service Tax imposed. For the most up-to-date bill layout, please visit here

8. Which billing components are subject to the Service Tax?

Service Tax is applicable only to billing components specified in Questoon 8.

10. I have an Individual Streetlight attached to my account. Is Service Tax charged on Individual Streelight consumption?

No, Individual Streetlight consumption is not subject to Service Tax.

11. TNB charges 1% interest on Late Payment. Is this subject to Service Tax?

No, the 1% interest Late Payment is not subject to Service Tax.

12. Is the 1.6% Kumpulan Wang Tenaga Boleh Baharu (KWTBB) contribution taxable under Service Tax?

No, the 1.6% KWTBB contribution is not subject to Service Tax.

13. What does TNB do with the Service Tax charged and collected from the electricity bill?

TNB, as a taxable entity, is required to charge the Service Tax as stipulated in the Service Tax Act 2018. The tax collected will be remitted to the Royal Malaysian Customs Department.

14. Where can I direct inquiries or find more information about the Service Tax charged by TNB on my electricity bill?

For residential customers receiving bills in March 2024, the Service Tax charge will be prorated based on the number of billing days in February 2024 (6%) and March 2024 (8%).

The following are sample bills for service tax calculation scenarios:

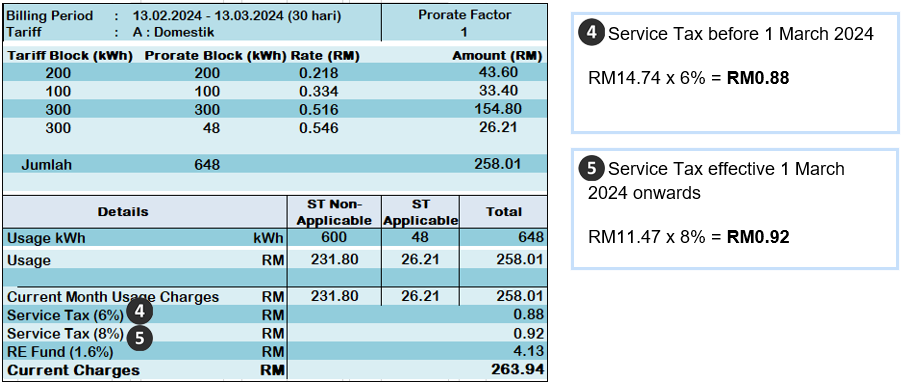

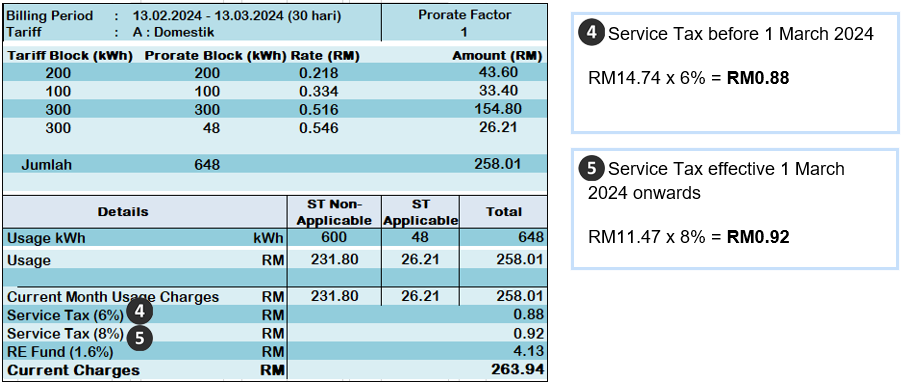

Example 1: Service tax calculation for Transition Month

Tariff: A- Domestic

Billing Period: 13.02.2024 - 13.03.2024 (30 days)

Usage: 648 kWh

.png)

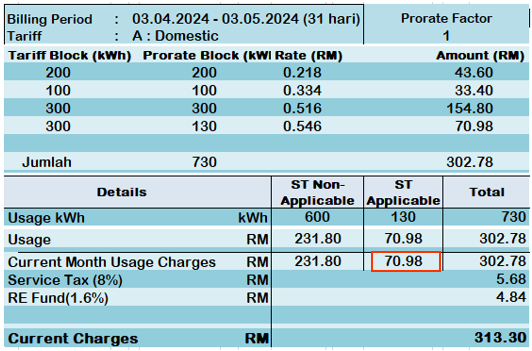

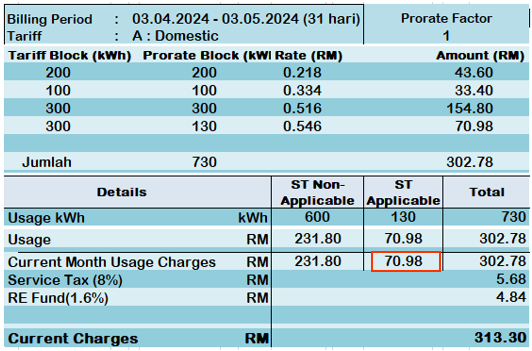

Example 2: Electricity Bill Calculation from 1 March 2024 (No Transition Period) with Billing Period 28 Days and above

Tariff: A- Domestic

Billing Period: 03.04.2024 - 03.05.2024 (31 days)

Usage: 730 kWh

Step 1:

Identify usage above 600kWh:

730kWh - 600kWh = 130kWh

Step 2:

Refer to the 'ST Non-Applicable' column.

Service Tax is calculated based on the current month's usage multiplied by the Service Tax rate.

RM70.98 x 8% = RM5.68

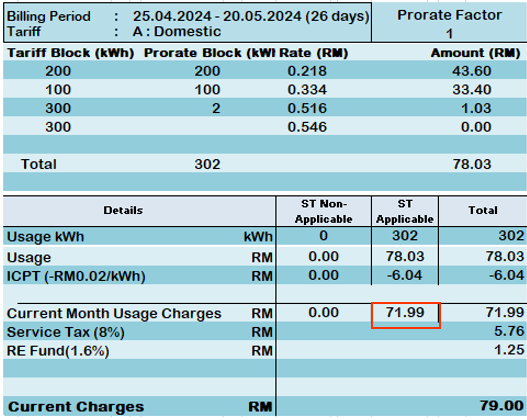

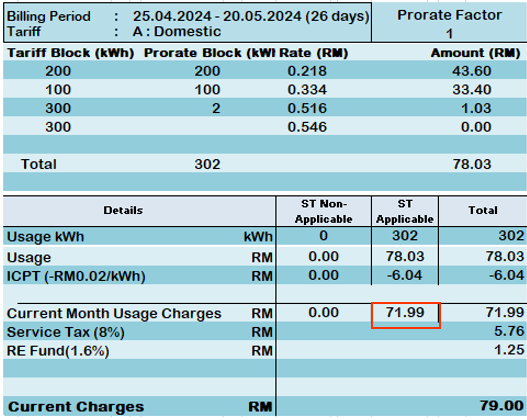

Example 3: Electricity Bill Calculation from 1 March 2024. (No Transition Period) with billing Period Below 28 days.

Tariff: A- Domestic

Billing Period: 25.04.2024 - 20.05.2024 (26 days)

Usage: 302 kWh

By checking the 'ST Applicable' column, Service Tax is applied to the total monthly usage (kWh) since the billing period is below 28 days.

RM71.99 x 8% = RM5.76

Information sources: Sales And Service Tax (sst) - Tenaga Nasional Berhad (tnb.com.my)

1. What are the tax charges that is applicable for electricity services?

- Under the Service Tax Act 2018, provision of electricity is prescribed as a taxable service under the Service Tax.

- However, not all TNB customers are subject to Service Tax. Service Tax is only applicable to residential customers (Tariff A- Domestic) subject to the following conditions:

i. Total electricity consumption which exceeds 600kWh; and the billing period is 28 days or more; OR

ii. If the billing period is less than 28 days, Service Tax will be imposed on your entire electricity consumption.

2. What is the rate of Service Tax applicable for electricity services?

The Service Tax rate was initially set at 6% as of 1 September 2018 and is increased to 8% starting from 1 March 2024 according to Service Tax (Rate of Tax) (Amendment) Order 2024 [Note: temporary message until end of August 2024].

The applicable Service Tax rate is 8% subject to the conditions mentioned on Q1.

3. Where can I find information regarding the list of taxable services, which includes electricity services?

Information regarding taxable services, individuals and the total value of taxable services can be found in the First Schedule [Regulation 3] under the Service Tax Regulation 2018.

4. Which TNB Customer Categories are applicable to Service Tax?

.png)

For more information regarding customer categories, please visit: 5. Why is my billing period less than 28 days?

Generally, the monthly billing cycle is set from 28 to 31 days. However, the billing period can be less than 28 days in the following scenarios:

- When customers request to terminate their supply contract with TNB.

- When customers sign a new supply contract with TNB.

- When customers request a change of tariff from Residential to Non-Residential or vice-versa.

- When consumers request a bill before the following billing cycle, the billing term is shorter than one month.

No, non- Residential customers are not governed under the Service Tax Act 2018.

7. Will my electricity bill show how much Service Tax I have to pay?

Yes, but this applies only to residential customers (Tariff A- Domestic). You will find a seperate line item clearly showing the Service Tax imposed. For the most up-to-date bill layout, please visit here

8. Which billing components are subject to the Service Tax?

- Energy consumption (kWh)

- Discounts (Service Tax will be calculated after discounts)

- Imbalance Cost Pass-Through (ICPT)

- Temporary Load Charge

Service Tax is applicable only to billing components specified in Questoon 8.

10. I have an Individual Streetlight attached to my account. Is Service Tax charged on Individual Streelight consumption?

No, Individual Streetlight consumption is not subject to Service Tax.

11. TNB charges 1% interest on Late Payment. Is this subject to Service Tax?

No, the 1% interest Late Payment is not subject to Service Tax.

12. Is the 1.6% Kumpulan Wang Tenaga Boleh Baharu (KWTBB) contribution taxable under Service Tax?

No, the 1.6% KWTBB contribution is not subject to Service Tax.

13. What does TNB do with the Service Tax charged and collected from the electricity bill?

TNB, as a taxable entity, is required to charge the Service Tax as stipulated in the Service Tax Act 2018. The tax collected will be remitted to the Royal Malaysian Customs Department.

14. Where can I direct inquiries or find more information about the Service Tax charged by TNB on my electricity bill?

- For inquiries, kindly contact TNB Careline at 1-300-88-5454; or email tnbcareline@tnb.com.my

- For more information, you can also visit Royal Malaysia Customs Department website https://mysst.customs.gov.my

For residential customers receiving bills in March 2024, the Service Tax charge will be prorated based on the number of billing days in February 2024 (6%) and March 2024 (8%).

The following are sample bills for service tax calculation scenarios:

Example 1: Service tax calculation for Transition Month

Tariff: A- Domestic

Billing Period: 13.02.2024 - 13.03.2024 (30 days)

Usage: 648 kWh

.png)

Example 2: Electricity Bill Calculation from 1 March 2024 (No Transition Period) with Billing Period 28 Days and above

Tariff: A- Domestic

Billing Period: 03.04.2024 - 03.05.2024 (31 days)

Usage: 730 kWh

Step 1:

Identify usage above 600kWh:

730kWh - 600kWh = 130kWh

Step 2:

Refer to the 'ST Non-Applicable' column.

Service Tax is calculated based on the current month's usage multiplied by the Service Tax rate.

RM70.98 x 8% = RM5.68

Example 3: Electricity Bill Calculation from 1 March 2024. (No Transition Period) with billing Period Below 28 days.

Tariff: A- Domestic

Billing Period: 25.04.2024 - 20.05.2024 (26 days)

Usage: 302 kWh

By checking the 'ST Applicable' column, Service Tax is applied to the total monthly usage (kWh) since the billing period is below 28 days.

RM71.99 x 8% = RM5.76

Information sources: Sales And Service Tax (sst) - Tenaga Nasional Berhad (tnb.com.my)

17 May 2024